The importance of tobacco taxes

The research is clear: increases in tobacco taxes decrease tobacco use. Indeed, raising taxes on tobacco and thereby increasing its price is one of the most effective ways to reduce tobacco use. Prices affect virtually all measures of cigarette use, including per-capita consumption, smoking rates and the number of cigarettes smoked daily. These effects apply across a wide range of racial and socioeconomic groups.

Smoking-related illnesses remain the leading cause of preventable death in the United States, with more than 540,000 deaths annually, and cost the country more than $300 billion each year, including $170 billion for direct medical care for adults and more than $156 billion in lost productivity. Yet the federal tax on cigarettes has not increased since 2009, when the Children’s Health Insurance Program Reauthorization Act raised the tax to $1.01 per pack. State taxes per cigarette pack average $1.78, with rates ranging from 17 cents in Missouri to $4.50 in Washington, D.C.

Truth Initiative® supports a set of policies regarding tobacco taxes, starting with federal, state and local tax authorities levying the highest possible taxes on cigarettes and all other combustible tobacco products, such as cigars, pipe, roll your own tobacco and hookah. Additionally, all tobacco products, including e-cigarettes, should be taxed at rates that discourage youth use. At this time, only 10 states tax e-cigarettes at all. That said, tax authorities should levy taxes on properly regulated e-cigarettes and products proven to be both less harmful and help move smokers away from combustible tobacco products at rates proportional to the harms of each type of tobacco product. We note that this strategy only works when taxes on combustible products are significant enough to both discourage youth uptake and to encourage smokers to switch to less harmful products. In many jurisdictions in the U.S., taxes, even on cigarettes, remain well below these levels.

Further, taxes on tobacco products should increase over time to continue to have the intended effect of encouraging quitting among current smokers, and preventing vulnerable populations, especially youth, from starting to use these products. Programs providing tobacco prevention and quitting services should receive a significant portion of funds garnered from all tobacco taxes, which will further protect communities from the toll of tobacco.

Specifically, Truth Initiative supports the following policies:

Tobacco Taxes Should Be Assessed at the Highest Possible Rates to Prevent Youth from Using Tobacco Products and to Encourage Adults to Quit

Taxes are a particularly effective tool for discouraging youth uptake of cigarettes. Youth and young adults are two to three times more likely to respond to changes in prices than adults, and health economists have estimated that raising the cost of cigarettes to $10 per pack nationwide would result in 4.8 million fewer smokers between the ages of 12-25. In fact, researchers who compared youth use just before and just after the federal cigarette tax increase in 2009 found that the tax led to at least 220,000 fewer middle and high school students taking up smoking.

Young people are more responsive to tax increases for several reasons, including their lower incomes, which make them more price sensitive, and the shorter amount of time spent smoking compared to older smokers, which makes them likely to be less addicted. Higher cigarette prices also make it more likely that adult smokers will quit.

While not as widely studied, tax increases on other tobacco products, such as cigars and smokeless tobacco, yield similar results in terms of reducing prevalence and consumption. A study of the 2009 federal tax increase on smokeless tobacco led to at least 135,000 fewer users immediately after the increase took effect. As a result, it is important to tax all tobacco products, including e-cigarettes and those products that have been granted modified risk status by the Food and Drug Administration, at sufficiently high levels to deter youth tobacco use. Only then can a differentiated tax structure work to encourage adult quitting.

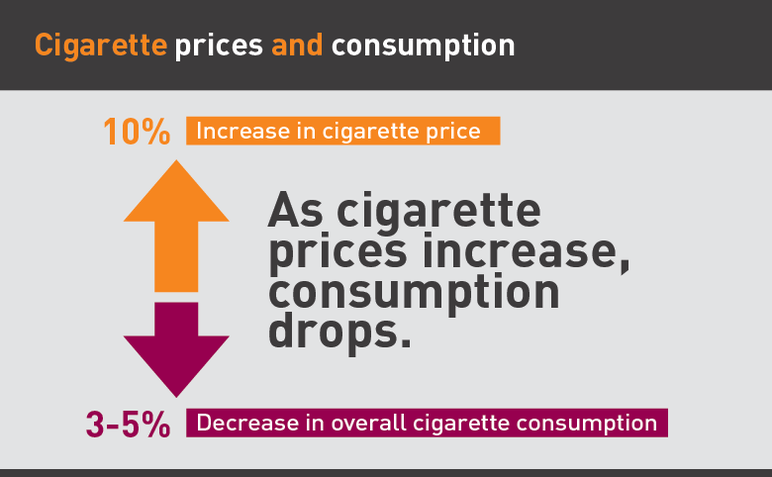

Further, tobacco taxes on all products should increase over time. Taxes must increase regularly to continue the effect of the taxes on reducing tobacco use. Moreover, increases in taxes should be meaningful and they should not be phased in, so that they have the strongest effect on changing tobacco use behaviors. We know that for every 10 percent increase in cigarette price, overall cigarette consumption is reduced by 3 to 5 percent. Thus, the higher the tax, the higher the decrease in tobacco use. At the same time, because the effect of a tax increase will naturally wear off over time, it is important to raise taxes periodically to ensure continued decreases in tobacco use.

The tobacco industry has also long understood the impact of price increases on smoking among young people. Internal tobacco company documents describe how cigarette price increases lead to significant reductions in smoking, particularly among young people. A 1985 Philip Morris internal document stated, “Of all the concerns, there is one— taxation—that alarms us the most. While marketing restrictions and public and passive smoking do depress volume, in our experience taxation depresses it much more severely. Our concern for taxation is, therefore, central to our thinking about smoking and health. It has historically been the area to which we have devoted most resources and for the foreseeable future, I think things will stay that way almost everywhere.” The economics behind this conclusion are as true today as they were in 1985. Indeed, the tobacco industry continues to put the full might of its considerable lobbying forces toward thwarting tobacco taxes. In 2016, the industry spent $71 million against a ballot initiative to raise the tobacco tax in California. In 2018 in Montana, a much smaller state, the tobacco industry spent $17.46 million against a ballot initiative to raise tobacco taxes there—the most expensive ballot measure in Montana history.

While marketing restrictions and public and passive smoking do depress volume, in our experience taxation depresses it much more severely. Our concern for taxation is, therefore, central to our thinking about smoking and health

Finally, an increase in tobacco taxes reliably leads to increased revenue by the government enacting the tax. This provides for “double bottom line” — increased revenue in state and local coffers and improved health and productivity for citizens.

Revenue Raised through Increased Taxes on Tobacco Products Should Support Tobacco Control Programs

Tobacco taxes raise revenue that should be used for tobacco control programs. Comprehensive programs fund things such as enforcement of tobacco control policies, quitting services, youth smoking prevention programs, surveillance programs and education about tobacco health effects, industry tactics and tobacco control policies.

When price increases are accompanied by comprehensive tobacco control programs, the impact of both is strengthened.

- For example, when New York City accompanied increases in local cigarette taxes with other tobacco control services and activities, cigarette smoking among adults declined by 19 percent between 2002 and 2006.

- In Oregon, a study found that the combination of a tax increase and the state’s tobacco prevention and education program decreased taxable per capita cigarette consumption by 11 percent.

- Washington state found a return of more than $5 for every $1 spent on its state tobacco program.

Funds for state tobacco programs are critical. The tobacco industry spent almost $9.5 billion in 2016 marketing its products in the U.S. In contrast, in fiscal year 2018, states dedicated only $721.6 million in tobacco prevention spending, less than 3 percent of the Centers for Disease Control and Prevention recommendation. The larger the investment states make in these programs, and the longer they sustain their programs, the greater and faster their impact.

Tax Authorities Should Institute Tax Parity between Cigarettes and All Combustible Tobacco Products

In 2009, the federal government increased the tax rate for small cigars much more than for large cigars. The Internal Revenue Code breaks cigars into two categories for the purpose of taxes: “small or little cigars,” which are the same size as cigarettes (3 pounds per 1,000 sticks), and “large cigars” that cover every other type of cigar that is larger than 3 pounds per 1,000 sticks. The federal tax rate for small cigars is the same as it is for cigarettes, at $50.33 per 1,000 (or $1.01 per pack of 20), while the tax on each large cigar is 52.75 percent of the sales price, but not to exceed 40.26 cents per cigar.

This led to small cigar manufacturers making minor product changes to add enough weight to legally classify them as large cigars for tax purposes, while they still appear to users to be cigarette replacement products at a much cheaper price. Despite a continued decrease in cigarette smoking in the U.S., consumption of large cigars has increased substantially since the federal tobacco tax increased in 2009. Manufacturers have been able to increase the per-unit weight of several small cigars to take advantage of a tax benefit when classified as large cigars, which are taxed based on the product price rather than per cigar. They did so by using fillers such as the clay found in kitty litter or stuffing the products with more tobacco to tip the scales in their favor. As a result of relatively minor increases in per-unit weight, the new “large cigar” can appear almost identical to a “small cigar,” which resembles a typical cigarette and can cost as little as 7 cents per cigar.

From 2000 to 2017, total small cigar consumption decreased 80.7 percent from 2.3 billion in 2000 to 440 million in 2017; however, large cigar consumption increased 332.1 percent from 3.9 billion in 2000 to 12.9 billion in 2017. This is a stark example of how price can dramatically affect rates of tobacco product use and demonstrates that governments should apply the highest tax rate to all combustible tobacco products.

Taxes Should be Proportional to the Harms of Each Type of Tobacco Product. This Tax Structure Requires Full Food and Drug Administration Regulation and Review of Products that Could Potentially Reduce Harms.

Not only can taxes prevent youth from using tobacco, they also encourage smokers to quit or, for those who cannot or will not quit, they can encourage smokers to switch completely to the least harmful tobacco products.

Given the epidemic rates of youth tobacco use, especially for e-cigarettes, federal, state and local tax-writing authorities should set taxes on all tobacco products, including e-cigarettes, at levels high enough to discourage non-users, particularly youth, from using them. Combustible tobacco products cause the most damage to health and should be taxed at the highest rate. However, not all tobacco products carry the same health consequences. A tax structure that uses a sliding scale based on product health impacts can discourage use of the most harmful products. For those who cannot or will not quit tobacco altogether, a comparatively lower tax rate makes those products that help smokers switch completely to significantly less harmful products more accessible, and increases incentives to quit the more expensive, and most harmful combustible products.

This policy proposal comes with a caveat. For this type of tax structure to work, the FDA must fully exercise its authorities to regulate tobacco and review products that have the potential to reduce tobacco-related harms. Such a tax structure cannot occur in the current environment where products purported to be the least harmful have not been reviewed by the agency. This lack of scientific review makes it impossible to determine which products reduce harms and help smokers switch completely from combustible products. Until that time, a tax rate proportional to health consequences cannot be put into action as tax agencies would not know which products truly reduce health harms. Nonetheless, even now, tax agencies can ensure that all tobacco taxes are high enough to prevent youth use and that all combustible tobacco products bear the highest tax.

Conclusion

Truth Initiative supports increases in taxes on cigarettes and other tobacco products as part of a comprehensive tobacco control program. Using the revenue raised from these tax increases for tobacco prevention and quitting services will help to magnify the impacts of the tax increase. These steps will prevent initiation of tobacco use, promote quitting, reduce the prevalence and intensity of tobacco use among youth and adults and result in positive economic impacts through revenue and savings of health and productivity costs. We encourage all states and localities, where allowed, to increase tobacco taxes and increase funding on tobacco control programs to improve the health of their citizens and make those locations healthier, more productive places to live.

More in tobacco prevention efforts

Want support quitting? Join EX Program

By clicking JOIN, you agree to the Terms, Text Message Terms and Privacy Policy.

Msg&Data rates may apply; msgs are automated.