Tobacco use in Minnesota 2019

Cigarette use: Minnesota

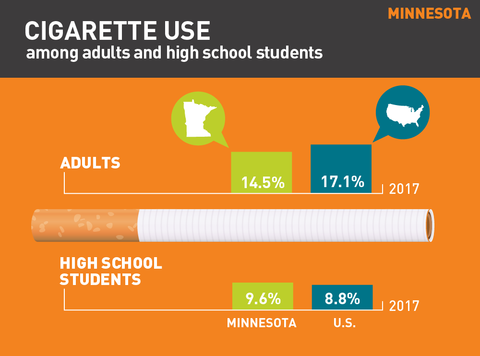

Cigarette use in Minnesota

- In 2017, 14.5% of adults smoked. Nationally, the rate was 17.1%.1

- In 2017, 9.6% of high school students in Minnesota smoked cigarettes on at least one day in the past 30 days. Nationally, the rate was 8.8%.2,3

Other tobacco product use: Minnesota

E-cigarette and smokeless tobacco use in Minnesota

- In 2017, 3.6% of adults used e-cigarettes and 4.8% used smokeless tobacco.4

- In 2017, 19.2% of high school students in Minnesota used electronic vapor products on at least one day in the past 30 days.2

- In 2017, 6.0% of high school students in Minnesota used chewing tobacco, snuff or dip on at least one day in the past 30 days.2

- In 2017, 10.6% of high school students in Minnesota smoke cigars, cigarillos or little cigars on at least one day in the past 30 days.2

Economics of tobacco use and tobacco control

Economics of tobacco use in Minnesota

- Minnesota received $703.6 million (estimated) in revenue from tobacco settlement payments and taxes in fiscal year 2019.3

- Of this, the state allocated $17.3 million in state funds to tobacco prevention in fiscal year 2019, 32.7% of the Centers for Disease Control and Prevention’s annual spending target.3

- Smoking-caused health care costs: $2.51 billion per year.5

- Smoking-caused losses in productivity: $1.54 billion per year.6

Minnesota tobacco laws

Cigarette tax in Minnesota

Tobacco taxes

- Minnesota is ranked 8th in the U.S. for its cigarette tax of $3.04 per pack (enacted January 2018), compared to the national average of $1.81. (The District of Columbia has the highest tax at $4.50 and Missouri has the lowest at 17 cents.)5-7

- Moist snuff containers weighing less than 1.2 ounces are taxed at the greater of 95% of the wholesale price or a minimum price equal to the cigarette tax at each container. Moist snuff containers weighing more than 1.2 ounces are taxed at the greater of 95% of the wholesale price or a minimum tax equal to the cigarette tax on each container multiplied by the number of ounces of moist snuff in the container, divided by 1.2 (container = smallest consumer-size can, package or other container that is marketed or packaged by an entity for separate sale to a retail purchaser).

- Premium cigars are taxed at 95% of the wholesale or 50 cents per cigar, whichever is less.

- All other tobacco products, including e-cigarettes, are taxed at 95% of the wholesale sales price.7,8

Clean indoor air ordinances

- Smoking is prohibited in all government workplaces (workplaces with two or fewer employees are exempt), private workplaces (workplaces with two or fewer employees are exempt), schools, childcare facilities, restaurants, bars, casinos/gaming establishments (tribal establishments are exempt), retail stores and recreational/cultural facilities.6

- The use of e-cigarettes is prohibited in day care and health facilities, government owned or operated buildings, facilities owed by Minnesota state colleges and universities, the University of Minnesota, facilities licensed by the commissioner of human services, and in public and charter schools and any facility or vehicle owned, rented or leased by a school district.9

Youth access laws

- The minimum age to purchase tobacco products in Minnesota is 21. In December 2019, the United States adopted a law raising the federal minimum age of sale of all tobacco products to 21, effective immediately.

- Minors are prohibited from buying nicotine delivery products, including e-cigarettes.5

- Self-service sales are prohibited, except in adult-only facilties.7,8

Local tobacco laws

- Minneapolis and 33 other localities in the state raised their minimum age requirement for the purchase of tobacco products to 21.10

- In Minneapolis and St. Paul, the sale of flavored tobacco products is restricted to tobacco product shops. The sale of menthol flavored tobacco products is prohibited except in adult-only tobacco shops and liquor stores.11,12

- In Duluth, Falcon Heights and Lauderdale, the sale of flavored tobacco products, including menthol, is prohibited except in adult-only tobacco stores.13-15

- In Mendota Heights, Robbinsdale, Shoreview and St. Louis Park, the sale of flavored tobacco products is prohibited except in adult-only tobacco stores. Menthol, mint and wintergreen flavors are exempt from the restriction.16-19

- In Arden Hills, the sale of all flavored tobacco products is prohibited.20

- In Minneapolis, Robbinsdale and St. Paul, the minimum price for cigars (after coupons and discounts have been applied and before sales tax) is $2.60 for a single cigar, $5.20 for a 2-pack or “double” pack, $7.80 for a 3-pack and $10.40 for packs with four or more cigars.12,17,21

- Rock County prohibits pharmacies from selling tobacco products.22

Quitting statistics and benefits

Quitting statistics in Minnesota

- The CDC estimates 46% of daily adult smokers in Minnesota quit smoking for one or more days in 2017.4

- In 2014, the Affordable Care Act required that Medicaid programs cover all tobacco cessation medications.8**

- Minnesota’s state quit line invests $13.18 per smoker, compared to the national average of $2.21.8

- Minnesota does not have a private insurance mandate provision for cessation.8

Notes and references

Updated April 2019

*National and state-level prevalence numbers reflect the most recent data available. This may differ across state fact sheets.

**The seven recommended cessation medications are NRT gum, NRT patch, NRT nasal spray, NRT inhaler, NRT lozenge, Varenicline (Chantix) and Bupropion (Zyban).

Fiore MC, et al. Treating Tobacco Use and Dependence: 2008 Update. Clinical Practice Guideline. Rockville, MD: US Department of Health and Human Services. Public Health Service: May 2008.

1. CDC, Behavioral Risk Factor Surveillance System, 2017.

2. Minnesota Youth Tobacco Survey, 2017.

3. CDC, Youth Risk Behavior Surveillance System, 2017.

4. CDC, Behavioral Risk Factor Surveillance System, State Tobacco Activities Tracking and Evaluation System, 2017.

5. Campaign for Tobacco-Free Kids, Broken Promises to Our Children: a State-by-State Look at the 1998 State Tobacco Settlement 20 Years Later FY2019, 2018.

6. Campaign for Tobacco-Free Kids, Toll of Tobacco in the United States.

7. American Lung Association, State Legislated Actions on Tobacco Issues (SLATI).

8. American Lung Association, State of Tobacco Control, 2019.

9. Public Health Law Center. U.S. E-Cigarette Regulation: 50-State Review. http://www.publichealthlawcenter.org/resources/us-e-cigarette-regulations-50-state-review.

10. Campaign for Tobacco-Free Kids. States and Localities that have Raised the Minimum Legal Sales Age for Tobacco Products to 21. https://www.tobaccofreekids.org/assets/content/what_we_do/state_local_issues/sales_21/states_localities_MLSA_21.pdf.

11. City of Minneapolis. An Ordinance of the City of Minneapolis by Yang and Gordon. Amending Title 13, Chapter 281 of the Minneapolis Code of Ordinances relating to Licenses and Business Regulations: Tobacco Dealers. 2015; http://www.ci.minneapolis.mn.us/www/groups/public/@clerk/documents/webcontent/wcms1p-142066.pdf. Accessed February 9, 2017.

12. St. Paul, Minnesota - Code of Ordinances. Title XXIX - Licenses, Chapter 324 - Tobacco, Section 324.07 - Sales prohibited. https://library.municode.com/mn/st._paul/codes/code_of_ordinances?nodeId=PTIILECO_TITXXIXLI_CH324TO_S324.07SAPR.

13. City of Duluth. Ordinance Amending Chapter 11 of the Duluth City Code to Restrict the Sale of Flavored Tobacco Products to Adult Only Smoke Shops. 2018; https://duluth-mn.legistar.com/LegislationDetail.aspx?ID=3298582&GUID=16CC3F1B-71AE-4B96-98DA-F91C8838D506.

14. Falcon Heights City Council. May 9, 2018 Meeting Agenda Packet. 2018; https://www.falconheights.org/vertical/sites/%7BA88B3088-FA03-4D5D-9D04-CCC9EF496399%7D/uploads/City_Council_Packet_5-09-18.pdf.

15. City of Lauderdale. Chapter 6: Tobacco, Tobacco Products, Tobacco-Related Devices, Nicotine or Lobelia Delivery Devices, and Electronic Delivery Devices. 2018.

16. City of Mendota Heights. Ordinance No. 522 Amending City Code Section 3-2 Tobacco Sales. 2018; http://public.mendota-heights.com/weblink/0/doc/194968/Page1.aspx.

17. City of Robbinsdale. Complying with Robbinsdale's Tobacco Product Requirements. http://www.robbinsdalemn.com/home/showdocument?id=10101.

18. The Association for Nonsmokers-Minnesota. Shoreview votes to restrict flavored tobacco. November 29, 2016.

19. City of St. Louis Park. St. Louis Park City Council bans flavored tobacco sales in St. Louis Park. 2017; https://www.stlouispark.org/Home/Components/News/News/130/18.

20. Campaign for Tobacco-Free Kids. States & Localities That Have Restricted the Sale of Flavored Tobacco Products. https://www.tobaccofreekids.org/assets/factsheets/0398.pdf.

21. City of Minneapolis. Complying with Minneapolis' Tobacco Flavor and Pricing Requirements. 2016; http://www.ci.minneapolis.mn.us/www/groups/public/@regservices/documents/webcontent/wcms1p-150533.pdf. Accessed February 9, 2017.

22. Americans Nonsmokers' Rights Foundation. Municipalities with Tobacco-Free Pharmacy Laws. http://no-smoke.org/pdf/pharmacies.pdf.

More in smoking by region

Want support quitting? Join EX Program

By clicking JOIN, you agree to the Terms, Text Message Terms and Privacy Policy.

Msg&Data rates may apply; msgs are automated.