Tobacco use in Washington 2018

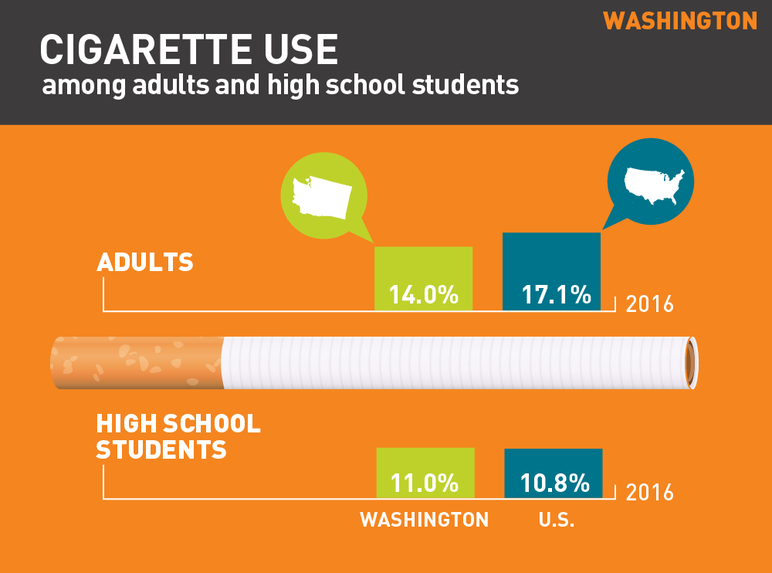

Cigarette use: Washington*

- In 2016, 14.0 percent of adults smoked. Nationally, the rate was 17.1 percent.¹

- In 2016, 11.0 percent of 12th graders smoked on at least one day in the past 30 days. Nationally, the rate was 10.8 percent.² ³

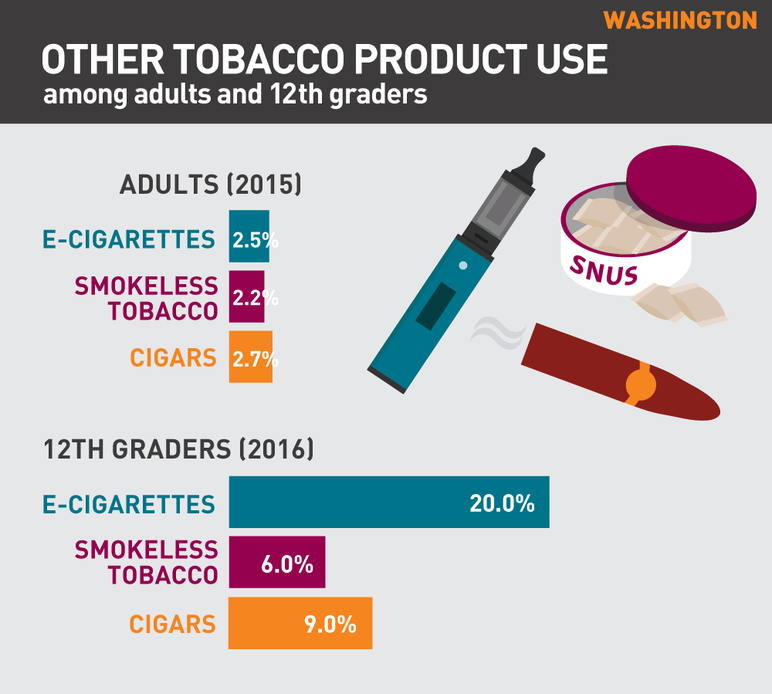

Other tobacco product use: Washington

- In 2015, 2.5 percent of adults used e-cigarettes, 2.2 percent used smokeless tobacco and 2.7 percent smoked cigars.⁴

- In 2016, approximately 6 percent of 8th graders, 13 percent of 10th graders and 20 percent of 12th graders used e-cigarettes on at least one day in the past 30 days.²

- In 2016, approximately 2 percent of 8th graders, 3 percent of 10th graders and 6 percent of 12th graders used smokeless tobacco on at least one day in the past 30 days.²

- In 2016, approximately 1 percent of 8th graders, 4 percent of 10th graders and 9 percent of 12th graders smoked cigars on at least one day in the past 30 days.²

Economics of tobacco use and tobacco control

- Washington received $563.0 million (estimated) in tobacco settlement payments and taxes in fiscal year 2018.⁵

- Of this, the state allocated $1.4 million in state funds to tobacco prevention in fiscal year 2018, just 2.2 percent of the Centers for Disease Control and Prevention’s annual spending target.⁵

- Smoking-caused health care costs: $2.81 billion per year⁵

- Smoking-caused losses in productivity: $2.2 billion per year⁶

Washington tobacco laws

Tobacco taxes

- Washington is ranked 8th in the U.S. for its cigarette tax of $3.025 per pack (enacted May 2010), compared to the national average of $1.73. (Connecticut and New York have the highest tax at $4.35 and Missouri has the lowest at 17 cents.)⁷ ⁸ ⁹

- Little cigars are taxed at 15.125 cents per cigar. All other cigars are taxed at 95 percent of the taxable sales price, not to exceed 65 cents per cigar. Moist snuff is taxed at the greater of $2.526 or 83.5 percent of the cigarette tax multiplied by 20 for consumer-sized cans or packages that weigh 1.2 ounces or less. Cans or packages that weigh more than 1.2 ounces are taxed at a proportionate rate for each ounce or fractional part of an ounce above 1.2 ounces. All other tobacco products are taxed at 95 percent of the taxable sales price.⁷ ⁸

Clean indoor air ordinances

- Smoking is prohibited in government workplaces, private workplaces, schools, childcare facilities, restaurants, bars, casinos/gaming establishments (tribal establishments exempt), retail stores and recreational/cultural facilities.⁷ ⁸

Youth access laws

- The minimum age of sale for tobacco products in Washington is 18.⁸

- Establishments are required to post signs stating that sales to minors are prohibited and violators will be punished. The sign must also state that photo ID is required to purchase tobacco products.⁷

- Minors are prohibited from buying vapor products, including e-cigarettes.⁷

Local tobacco laws

- The use of smokeless tobacco is prohibited at professional sports venues in King County, including Safeco Field, CenturyLink Field and KeyArena.¹⁰

Quitting statistics and benefits

- The CDC estimates that 48.0 percent of daily adult smokers in Washington quit smoking for one or more days in 2016.¹¹

- In 2014, the Affordable Care Act required that Medicaid programs cover all quit medications.⁸**

- Washington’s state quit line invests 42 cents per smoker, compared to the national average of $2.10.⁸

- Washington does not have a private insurance mandate provision for quitting tobacco.⁸

Notes and references

Updated June 2018

* National and state-level prevalence numbers reflect the most recent data available. This may differ across state fact sheets.

** The seven recommended cessation medications are NRT gum, NRT patch, NRT nasal spray, NRT inhaler, NRT lozenge, Varenicline (Chantix) and Bupropion (Zyban). Fiore MC, et al. Treating Tobacco Use and Dependence: 2008 Update. Clinical Practice Guideline. Rockville, MD: US Department of Health and Human Services. Public Health Service: May 2008.

- CDC, Behavioral Risk Factor Surveillance System, 2016.

- Washington State Healthy Youth Survey, 2016.

- CDC, Youth Risk Behavior Surveillance System, 2017.

- CDC, State-Specific Prevalence of Tobacco Product Use Among Adults - United States, 2014-2015, MMWR.

- Campaign for Tobacco-Free Kids, Broken Promises to Our Children: a State-by-State Look at the 1998 State Tobacco Settlement 19 Years Later FY2018, 2017.

- Campaign for Tobacco-Free Kids, Toll of Tobacco in the United States, 2018.

- American Lung Association, SLATI State Reports, 2017.

- American Lung Association, State of Tobacco Control, 2018.

- Campaign for Tobacco-Free Kids, State Cigarette Excise Tax Rates & Rankings, 2018.

- Knock Tobacco Out of the Park. https://tobaccofreebaseball.org/.

- CDC, Behavioral Risk Factor Surveillance System, State Tobacco Activities Tracking and Evaluation System, 2016.