Tobacco use in Idaho 2023

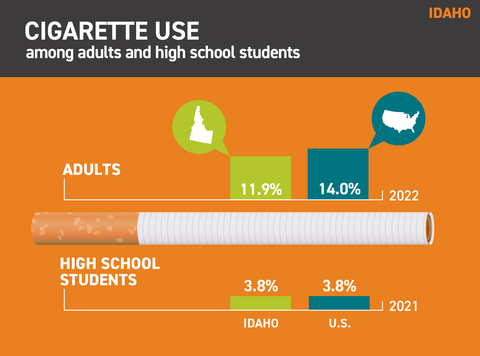

Cigarette use: Idaho*

Smoking rate in Idaho

- In 2022, 11.9% of adults in Idaho smoked. Nationally, adult smoking prevalence was 14.0%.1

- In 2021, 3.8% of high school students in Idaho smoked cigarettes on at least one day in the past 30 days. Nationally, the rate was 3.8%.2

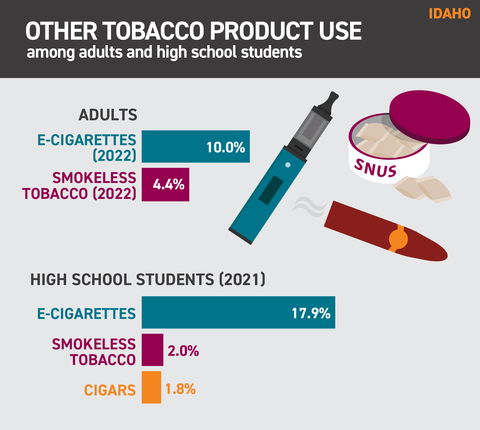

Other tobacco product use: Idaho*

Vaping rate in Idaho

- In 2022, 10.0% of adults in Idaho used e-cigarettes. Nationally, adult e-cigarette use prevalence was 7.7%.1

- In 2022, 4.4% used smokeless tobacco everyday or some days. Nationally, adult smokeless tobacco use prevalence was 3.4%.1

- In 2021, 17.9% of high school students in Idaho used electronic vapor products on at least one day in the past 30 days. Nationally, e-cigarette use prevalence among high school students was 18%.2

- In 2021, 2.0% of high school students in Idaho used chewing tobacco, snuff or dip on at least one day in the past 30 days. Nationally, smokeless tobacco use prevalence among high school students was 2.5%.2

- In 2021, 1.8% of high school students in Idaho smoked cigars, cigarillos or little cigars on at least one day in the past 30 days. Nationally, cigar use prevalence among high school students was 3.1%.2

Economics of tobacco use and tobacco control

Tobacco taxes in Idaho

- Idaho received $73.4 million (estimated) in revenue from tobacco settlement payments and taxes in fiscal year 2022.4

- Of this, the state allocated $4.4 million in state funds to tobacco prevention in fiscal year 2022, 28.5% of the Centers for Disease Control and Prevention’s annual spending target.4

- Smoking-related health care costs: $590 million per year4

- Smoking-related losses in productivity: $1.1 billion per year5

Idaho tobacco laws

Idaho tobacco laws

Tobacco taxes

- Idaho is ranked 46th in the U.S. for its cigarette tax of 57 cents per pack (enacted June 2003), compared with the national average of $1.93. (New York has the highest tax at $5.35 and Missouri has the lowest at 17 cents.) 6-8

- All other tobacco products are taxed at 40% of the wholesale sales price.6,7

Clean indoor air ordinances

- Smoking is prohibited in all government workplaces, schools, childcare facilities, restaurants, casinos/gaming establishments (tribal establishments exempt), retail stores and recreational/cultural facilities.6,7

- Smoking restrictions are required in private workplaces.6,7

- There are no smoking restrictions in bars.7

- Vaping is prohibited in the interior of the State Capitol and restricted to designated areas in exterior. Otherwise, no smoke-free restrictions exist for e-cigarette use.9

Licensing laws

- Retailers and wholesalers are required to obtain a license to sell tobacco products.6

- A license is required to sell e-cigarette products.9

Youth access laws

- In December 2019, the United States adopted a law raising the federal minimum age of sale of all tobacco products to 21, effective immediately.

- Only sale clerks are allowed to access tobacco products prior to sale.6,7

- Establishments are required to post signs stating that sales to minors are prohibited.6,7

- The sale or distribution of electronic smoking devices to persons under age 21 is prohibited. Delivery sale of electronic smoking devices requires age verification (through credit/debit card verification of name and age) that purchaser is 21 years or older. Shipment of electronic smoking devices must include a statement regarding the prohibition on shipping to individuals under the age of 21.9

- The sale or distribution of electronic smoking devices for free or below cost to members of the public in public places or events is prohibited.9

Quitting statistics and benefits

Quitting smoking in Idaho

- The CDC estimates that 42.8% of daily adult smokers in Idaho quit smoking for one or more days in 2019.3

- In 2014, the Affordable Care Act required that Medicaid programs cover all quit medications.7**

- Idaho’s state quit line invests $4.53 per smoker, compared with the national median of $2.37.7

- Idaho does not have a private insurance mandate provision for quitting tobacco.7

Notes and references

Notes and references

Updated June 2023

* The datasets for both adults and youth prevalence were used to make direct comparisons at the state and national levels. National prevalence reported here may differ from what is reported in our national-level fact sheets. The numbers here also reflect the most recent data available. Dates of available data may differ across state fact sheets.

**The seven recommended quitting medications are NRT gum, NRT patch, NRT nasal spray, NRT inhaler, NRT lozenge, Varenicline (Chantix) and Bupropion (Zyban).

Fiore MC, et al. Treating Tobacco Use and Dependence: 2008 Update. Clinical Practice Guideline. Rockville, MD: US Department of Health and Human Services. Public Health Service: May 2008.

1. CDC, Behavioral Risk Factor Surveillance System, 2022.

2. CDC, Youth Risk Behavioral Surveillance System, 2021.

3. CDC, Behavioral Risk Factor Surveillance System, State Tobacco Activities Tracking and Evaluation System, 2021.

4. Campaign for Tobacco-Free Kids, Broken Promises to Our Children: a State-by-State Look at the 1998 State Tobacco Settlement 24 Years Later FY2023, 2023.

5. Campaign for Tobacco-Free Kids, Toll of Tobacco in the United States.

6. American Lung Association, State Legislated Actions on Tobacco Issues (SLATI).

7. American Lung Association, State of Tobacco Control, 2023.

8. Campaign for Tobacco-Free Kids. State Cigarette Excise Tax Rates & Rankings. https://www.tobaccofreekids.org/assets/factsheets/0097.pdf. Accessed October 4th, 2023.

9. Public Health Law Center. U.S. E-Cigarette Regulation: 50-State Review. http://www.publichealthlawcenter.org/resources/us-e-cigarette-regulations-50-state-review. Accessed October 4th, 2023.